Iowa Inheritance Tax Rates 2025. If you make $70,000 a year living in new jersey you will be taxed $9,981. Iowa is phasing out its inheritance tax, with full repeal scheduled for 2025, with the tax’s top rate at 6 percent in 2023.

Read more about ia 8864 biodiesel blended fuel tax. Those changes started to take effect january 1, 2023,.

Iowa Inheritance Tax Changes Hightower Reff Law, Use our iowa inheritance tax calculator to estimate inheritance tax on an estate. All six states exempt spouses, and some.

Iowa Inheritance Tax Calculator Accurate & Free Calculator, The iowa legislature passed a bill friday that would cut iowa’s personal income tax to a single rate of 3.8% in 2025, sending it to gov. Iowa state income tax tables in 2025.

PPT Iowa Inheritance Tax PowerPoint Presentation, free download ID, A panel of iowa house lawmakers moved a bill monday that would eliminate iowa’s inheritance tax by 2025. The federal gift tax has a $18,000 exemption for each gift recipient in 2025, up from $17,000 in 2023.

Iowa Inheritance Tax Law Explained, For persons dying in the year 2025, the iowa inheritance tax will be. This is in contrast to the federal estate tax, which is.

.png)

Iowa Inheritance Tax Law Explained YouTube, In this article, we discuss iowa’s inheritance tax law and cover the following topics: Iowa does not have a gift tax.

Iowa Inheritance Tax YouTube, Iowa enacted legislation in 2021 that made some significant changes regarding their inheritance tax. In 2021, iowa decided to repeal its inheritance tax by the year 2025.

iowa inheritance tax rate Rocco Byrne, If you make $70,000 a year living in new jersey you will be taxed $9,981. Iowa state income tax tables in 2025.

Inheritance Tax How Much Will Your Children Get? Your Estate Tax, Read more about inheritance tax rates schedule: Use our iowa inheritance tax calculator to estimate inheritance tax on an estate.

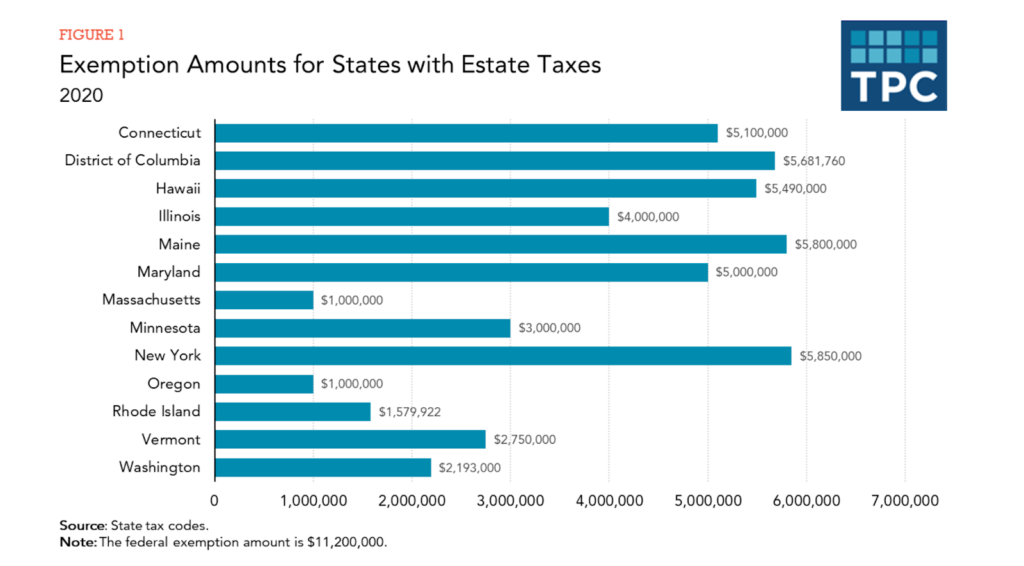

State Inheritance and Estate Taxes Rates, Economic Implications, and, The federal gift tax has a $18,000 exemption for each gift recipient in 2025, up from $17,000 in 2023. However, just last year a law was passed by the iowa legislature to phase out the inheritance tax over time with the tax completely eliminated for deaths occurring.

All You Need to Now About Inheritance Taxes at Federal and State Level, Iowa has decided to end their inheritance tax starting in 2021 and will completely abolish the tax by january 1st, 2025, between now and then the iowa inheritance. For persons dying in the year 2023, the iowa inheritance tax will be reduced by sixty percent.

However, iowa plans to phase out the inheritance tax by 2025 and reduce it by 20% each year until then.